New Dutch pension legislation announced – Starting date no later than July 1, 2023

All employers need to get started, including you!

The new pension legislation forces companies and pension funds to act; with the requirement to be compliant as per 1 July 2027 at the latest. The new pension legislation will change all active pension plan provisions to a defined contribution structure.

Not only pension schemes that are administered by pension funds, but also collective pension schemes of companies that are placed with a pension insurer or premium pension institution, will need to be adjusted in time to comply with the new pension legislation.

High stakes & big decisions to be made before mid-year 2023

Dutch government has been discussing pension system reforms with the pensions industry and labor unions which will have a dramatic impact on company pension plans. After years of discussions, Dutch pension law will change as per July 1, 2023 at the latest.

Investigate your strategic options, preferably this year. This will leave you with sufficient time to decide ánd properly implement any changes. The longer you wait, the fewer options you will have available.

Defined Contribution and Defined Benefit pension plans impacted

The aim of the new pension legislation is to make pensions more transparent and personal. Also, the new pension rules will be more appropriate with current workforce mobility.However, while the costs of providing the pension to employees will be fixed and transparent, the new design lacks any guarantees and certainties with respect to pension benefits.

All pension plans will be Defined Contribution (DC) from 2027 at the latest

Active career average and final pay plans (DB plans) will cease to exist from 2027 at the latest. It is important to replace this type of pension plan on time by a DC plan.

Existing DC plans with an age-dependent, progressive contribution structure will be allowed to continue without change for current employees. Hence, if it is attractive to provide a DC pension plan which has an age-related contribution structure reflecting the pension benefits of the current DB plan, the new DC pension plan should be set up before 2027 at the latest.

The new pension legislation will affect all DC- and DB-pension plans, for all types of pension providers: industry wide-, company and general pension funds, pension premium institutions and pension insurance companies.

Insight

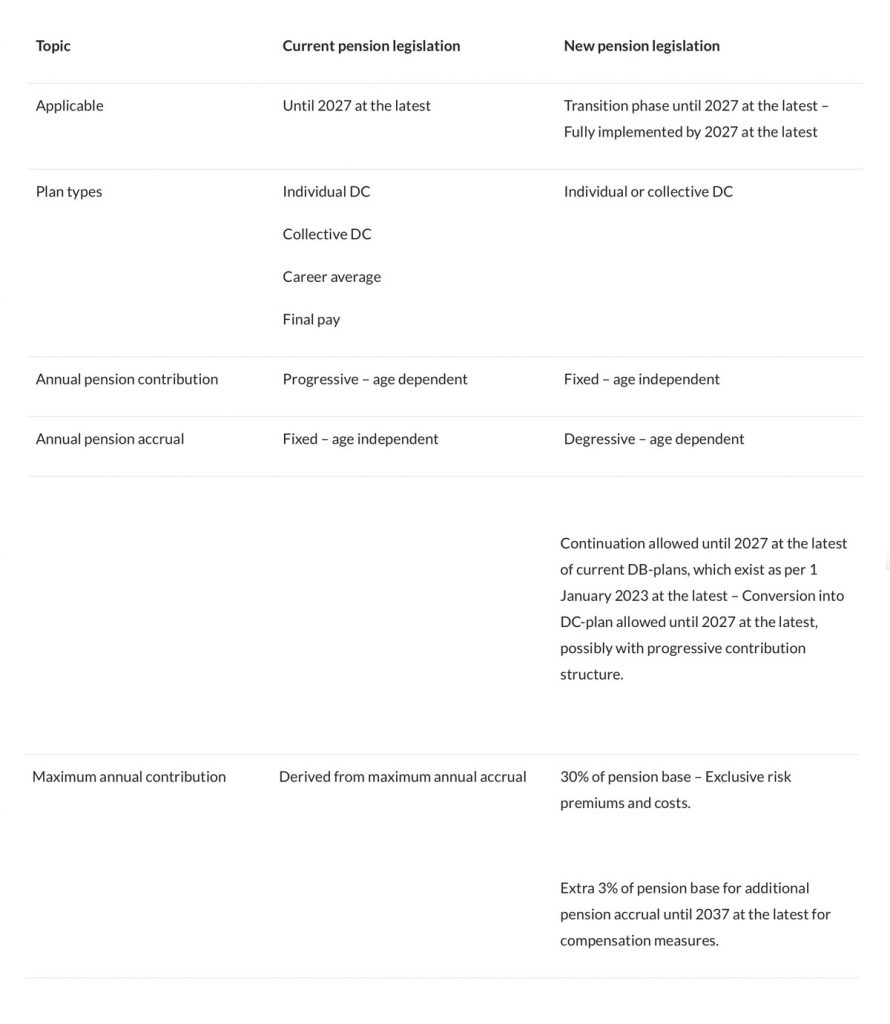

How does the new pension legislation differ from the current pension legislation? The table below shows a compact comparison of the current and new pension legislation.

Topic | Current pension legislation | New pension legislation |

Applicable | Until 2027 at the latest | Transition phase until 2027 at the latest – Fully implemented by 2027 at the latest |

Plan types | Individual DC Collective DC Career average Final pay | Individual or collective DC |

Annual pension contribution | Progressive – age dependent | Fixed – age independent |

Annual pension accrual | Fixed – age independent | Degressive – age dependent |

Grandfathering | NA | Continuation allowed of current DC-plans with progressive contribution structure per 2027 at the latest, for existing employees.

Continuation allowed until 2027 at the latest of current DB-plans, which exist as per July 1, 2023 at the latest – Conversion into DC-plan allowed until 2027 at the latest, possibly with progressive contribution structure.

|

Maximum annual contribution | Derived from maximum annual accrual | 30% of pension base – Exclusive risk premiums and costs.

Extra 3% of pension base for additional pension accrual until 2037 at the latest for compensation measures. |

Important deadlines

2022 for DB-plans

If a career average or final pay pension plan is in place, strategic advice is required. Preferably already this year, to ensure you to have the full scope of options at your disposal. Particularly with respect to grandfathering options.

2022 for DC-plans

Also for existing DC-plans, acting on time is crucial. Our recommendation is to investigate your options this year, to ensure you are aware and can take full advantage of all possibilities of the new pension legislation, which is especially true for grandfathering options.

How can Phenox Consultants help you?

The new pension legislation will – most likely – have a major impact on the current company’s collective pension plan. How can we assist you?

- Strategic advice current DB-pension plans. We will come up with the best solution on how to proceed, taking into account that DB-plans will no longer exist from 2027 at the latest.

- Strategic advice current DC-pension plans and compensation plan design.

- Determination of the flat rate pension premium.

- Inventarisation of the best possible grandfathering options.

- Drawing up a complete and workable transition plan which includes all relevant actions.

- Performing a balance sheet & future benefit cost impact analysis of cash- (local) and accrual (IFRS/USGAAP) accounting.

- Other pension related topics.

Would you like to have a grip on your deadlines?

We will gladly schedule a meeting free of obligation. Contact us:

Phenox Consultants

+31 (0)10 205 3500

info@phenoxconsultants.cw

Please take note that the information above is based on currently available facts. In the process of drawing up the intended new pension legislation, modifications could be applied.

Get Ahead with Phenox

Curious as to how Phenox Consultants can help advance your works council?

Our experts will gladly provide their input. Contact us directly, or request information free of obligation.